tv [untitled] November 3, 2012 11:00pm-11:30pm EDT

11:00 pm

israel sounds the alarm over a syrian tank incursion into the golan heights buffer zone residents report exchanges of heavy fire in the area. meanwhile in syria rebels fighter rebel fighters face war crimes allegations after a video of the apparent lynching of pro assad troops surfaces online. and mitt romney and barack obama duke it out for swing state votes in the last leg of an election campaign critics say bears the hallmarks of reality t.v. . and up next laura lister takes a look at whether the u.s. economy can make a full recovery in capital account stay with us. good

11:01 pm

afternoon welcome to capital account i'm lauren lyster here in washington d.c. these are your headlines for friday november second two thousand and twelve jobs numbers for october show the unemployment rate inching up a tenth of a percent to seven point nine percent but this is because more people entered the labor force which may be a good sign and payrolls climbed more than forecast so are we seeing incremental improvements on the labor front houses dana is that given all the stimulus measures in place since two thousand and eight and what do wages indicate about an economic recovery or lack thereof we'll talk about it and today the buzz is the labor department report yesterday it was the private a.t.p. jobs report reportedly showing companies expanding payrolls the most in eight months now these numbers get so much buzz when they come out less so when revisions are later released what can we learn from a.d.p.s revisionist history that could temper our expectations and from superstorm sandy's price gouging to catastrophe

11:02 pm

bonds to why you would citizens don't vote for a third party candidate you wrote as will respond to you and your feedback let's get to today's capital account. all right so the jobs report out today shows one hundred seventy one thousand jobs were added last month look at nonfarm payrolls beating median analyst expectations of one hundred twenty five thousand according to bloomberg and more than that one hundred forty eight thousand added in september which by the way was revised up now this is all according to the labor department the numbers come out every month the headline unemployment rate number went up a notch but that's because more people entered the workforce five hundred seventy

11:03 pm

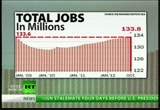

eight thousand more edging the labor force participation rate up to sixty three point eight percent now this is a number we've seen declined steadily since two thousand and eight but it's been going the other direction the last few months here's where we are in context the economy has added private sector jobs bit by bit for thirty two consecutive months amounting to one hundred eleven point seven million but when you look at the number of people employed since the day barack obama took office let's use that as a gauge as we are ahead of elections next week that number is pretty much the same one hundred thirty three point six million in january of two thousand and nine versus one hundred thirty three point eight million as of last month and when you look at the increase in wages which have not been keeping up with inflation according to the b.l.s. does this tell us a different story in terms of a u.s. economic recovery or a lack there of well mike should lock investment advisor for cit because that

11:04 pm

capital and author of mischa's global economic trend analysis is here to talk about it all he crunches the numbers every month and manages to find so much more than we hear about in the mainstream media so thanks for being on the show this is going to be a bit of a tradition talking jobs numbers when these reports come out so i'm happy you're on . well it's pleasuring back on the show again and you want to make this sort of a regular feature. they will write a let's go where my letter that i left at lorne emissions payroll friday let's start with last month ok payrolls better than expected september revised data august revised at its fabric jobs report is a pretty good report right now is a very good report and actually i was kind of surprised by that well you know i don't know i mean looking at what you know eighty eight came out with yesterday you know or the other day revising the entire year now by zero hedge calculation about a hundred thirty six thousand jobs was at it and i went excuse me

11:05 pm

yes three hundred sixty five thousand i went back and said who let's look at this for the course of the last twelve months it was like four hundred nineteen thousand at roughly thirty five thousand jobs a month that's a pretty big monitor berty big mess but then if you look at two thousand and eleven they were wrong on the other direction by about two hundred twenty nine thousand jobs or several so you know that one's credence to the theory war and you know that the recovery was actually little bit better than what people saw it in two thousand and eleven and it's not as good here in two thousand and twelve. unless you want to make anything out of the a.t.p. numbers at all because i issue kind of a curious statement lauren that has tend to want to match the last numbers over time really really is that supposed to make us feel good. so why don't

11:06 pm

they just reported to numbers of what they're saying because these are actual jobs numbers are the largest processors the united states well our you know how about just reporting the number and then if they want a little spend. you know what they think it might really mean for the b.o.'s rather than trying to be a last resort. when they're wildly off in one direction and then another while an orderly. and it would seem that the whole point of having a g.p. is having a private gauge versus the public numbers that we get from the b.l.s. each month let's talk more about what came out in the b.l.s. report though because headline numbers might look pretty good but obviously there's so much to pick out of this report that doesn't make it into the headline numbers that people pay so much attention to so one thing that i was looking at ok though we've been adding more jobs we've seen average work week be stuck at around thirty four point four hours for four consecutive months what do you take from this. well

11:07 pm

the average work week is stark but actually if you look at the end backs of average hours that really jumped out at me today especially in light of the really good payroll report it fairly well actually it's hardly budged all year so what does that tell you to others you are hiring more workers but up there the number of hours there were certainly isn't going up we talked about this last month where i said. i thought obamacare was a factor in that well i'm positive now that obamacare is is is a factor in that we've seen all kinds of corporations come out big chains like you know red lobster and and and all the restaurants are coming out to reducing the number of hours i get a call from a friend said a who who said that he works for

11:08 pm

a large chain and got about two thousand and part time workers every one of them was informed today that the number of hours they're going to be allowed to work is going to drop from thirty to twenty five because in a modern as we're talking about twenty percent more workers are going to need to be hired because they're reducing the hours of part time workers. there so the rise in employment law and that's it right there will end in ways that rise from obamacare and you're sticking to that obamacare thesis despite the revision in part time jobs for september which was revised down after that huge number was reported. well we had what was last month was eight hundred fifty two hundred sixty two thousand jobs but tell you the last month they were i would see that we expect to see a resurgent reversion to the mean here we're going to got not the direction that i expected by the way because full time employment actually rose today right but what

11:09 pm

we're looking at is you know one good number you know not in context what this trend has been really all year towards you know more part time employment and a lot of people tell me you know and quite accurately as they've met you know you can't blame all of this on obamacare but i never did in the first place or all i said was it was a factor right so we've had this trend towards part time employment for a long time yet we have why because companies don't want to pay wages so obamacare didn't create things but obamacare. the trend up because the definition of full time employment you know obamacare where they have to pay for medical coverage expel from the b.l.s. . definition use more than thirty four hours a week while the care definition lauren is thirty hours away huh so and that's on

11:10 pm

average sourcing company saying my god i don't know i don't want these employees working an average of thirty hours they cut it down to twenty five just to be safe right so that's what's going on that's you know all part of this trend towards part time employment towards lower wages salaries been stagnant yeah for why don't we time your lauren absolutely and i want to get into that in a moment but first one thing that you were telling me earlier and that i thought was very interesting is that the types of jobs that have been created we're talking about part time jobs this kind of feeds into that because obviously in the b.l.s. reports we get every month they say. what sectors added jobs last month i think it was retail and travel and leisure and some of the areas that we've seen they send month after month but there's another way to look at these jobs that have been added and it's covered employment meeting the number of jobs that are covered. by unemployment insurance if you lose a and that is a number that's reported and you track it and what does that gauge shell us about

11:11 pm

the type of jobs that are lost or create. covert employment i get reports periodic they actually getting them every month now from a guy named jim wallace does a great job send we send charts i expect to have some more charts out next week i'm covered employment is covered employment is the number of people who are working that actually have benefits they're actually covered by unemployment insurance so in other words if they lost their job would they get any unemployment benefits now as has as you're aware people like myself. are self-employed we have to pay yeah we have to pay unemployment insurance but if i lose my job if something happens if i have no income coming in at the moment i'm not eligible i can't receive unemployment benefits now the number in two thousand and eight we had one hundred thirty and a half million roughly one hundred forty six million people were covered so one

11:12 pm

hundred thirty out of one hundred forty six million now we're down to. one hundred twenty five million you know the words in the last four years we've lost sight and a half million but i defy going to have million people who no longer are covered why on employment insurance it's so either they're working. for themselves or self-employed and i'm mad i have to ask how many of these people are selling trinkets on e bay where they call you know the b.l.s. calls them up and says did you work any hours this week and they said yes i sold you know one trade get on e bay for two dollars now. we're since considered to be employed so here is the truth and here we lost part of a million people don't want it and now we're. one hundred thirty million program hundred forty six million four years later here we are we're.

11:13 pm

one hundred twenty five billion that are covered out of the hundred forty three so we're down three million and we're down another by covered employment in the rest warrior and that speaks to to what you can see factored into the jobs numbers which is how much money people actually are taking home when you mention wages and touched upon that we're going to get to it after the break but if you aren't covered if you don't have benefits you may be are paying for health insurance out of pocket or you don't have it at all but it's another one of those factors that you can't quite quantify in the jobs numbers real quickly i do want to play because michelle you talked about before that you know you can't put too much stock in these jobs numbers you can't put too much stock in looking at a.t.p. i have other guests that have said the same thing about g.d.p. or b.l.s. or whatever one area that some people have said is a good place to look for an economic indicator is the following i want to play a clip. you should look at wages look at real wages the per

11:14 pm

the amount of money that a person earns per hour is tells you whether his effort is paying off for him should pay attention to standards of living at the show at the medium real income in other words inflation adjusted income of households would be probably a better measurement of whether the economy is doing well or not. so it's and i don't know if you know it or not we're going to see more but i know that was yesterday. in a second what was more. excellent and yeah you know and i welcome ball yeah and you know as well michel and when we get back from the break i want to hear you add to their and analysis i have to go to break real quick but when we get back we'll have you talk more about wages a lot more with mike shad lock in just a moment also still ahead you responded in rows and we'll read your back and respond to you it is friday after all that's at the end of the show but first the

11:15 pm

11:16 pm

11:17 pm

11:18 pm

break i played a couple of clips you name them accurately bill bonde or mark talking about the importance of wages as an economic indicator better then than anything else do you agree that this is the best indicator of an economic recovery or lack there of. i think one needs to look at a number of things but certainly us put it this way that's a very good indicator and it's even worse than what those guys mentioned because there's skill involved here there are you know union workers who are getting above average wage hikes at least in comparison to everyone else the and certainly some upper echelon you know job workers are getting some you know pretty big hungry and graces and it's all average debt you still average all of that and the trends that are going down like that so what does that site that says you know that there's a certain class there that perhaps not getting any wage hikes at all no nobody creates in their take on bank yet and another thing mark flaubert.

11:19 pm

and sharon and i'm sure they would agree with me on this you have to factor a tax hike got illinois taxes my income taxes went out from three to five percent you know that's two percentage points were right out of my paycheck bubble and yet you know across the board sales taxes are going up look at california right now it's got a post out of the other day you're talking about a temporary tax and rates for something like a seven or twelve year when you go to grave you know temporary seven years. that operate taxes keep going up yeah that's not factored into the c.p.i. up right so you know we don't get wages you know. groceries you go to the grocery store all of a sudden you're paying six percent per on tax and groceries well you're panicking yeah yeah and you know that's two percent that's your in the might be your entire salary right just going up crease taxes right so you know

11:20 pm

it's not factored in the c.p.i. that's not it's back there down to real a way to say oh you say oh you know your wages were this last year well what about your benefit what about. right. group of all member. real wages decline are going right much more seriously than the reported so it looks like and there are words of one going to go yeah and i can joke i guess so you're saying it's worse than even the report shows and i can show what the report indicates let's take a look at the b.l.s. tells us has been happening to wages so these are average hourly earnings the year on year change and the change of the increase year on year has been declining it was one point one percent last month and it's been on decline since december of two thousand and eight so that's less than inflation it's not keep wages are not keeping up with inflation you bring up the question so are you is this

11:21 pm

a recovery for exactly because some people are seeing their wages stagnate some people are still seeing their wages increase and that gets into this issue of income inequality in this country what do you think is really behind it. well we know what's behind us at least i do but a lot of there is a lot of the basics in the economic sphere is as to whether there has and has in all kinds of body there is but it's really very simple it's it's it's all the effects of inflation and i'm by inflation here i'm talking about increase in money supply the fed steps on the you know gives money to the banks who benefits from that the people that have first access to money are the ones that benefit the most the people that have assets are the ones that benefit well so who is not an ak you said that he's doing this to increase jobs well where are that we've had roughly five trillion in stimulus they don't call us demi less but it's a little bit percent you know who you know if i was to about asked group of mine.

11:22 pm

who are five years ago with five trillion and instead of us of better not i think he probably would have said yes that's what we had is we are truly in a class deficits every year you know where did it go who benefited from all that and how it went and you know ridiculous schemes in an energy that are now bankrupt under obama it you know raised you get in wages bought you know to paper those union wages. prices were not a tax on excited to admin unions are still clamoring for more money you got all of these factors but what this all was balls around fractional reserves lending and the ability for banks twenty light right the people with her stack system money and the wealthy are the ones that benefit yeah those rates of the party one more point mark those rates are the party that was the last in right on credit look at the housing bust look at what happened in two thousand and six when it's finally

11:23 pm

average a lot of access to credit while they got into the housing but what exactly the wrong time they got murdered by mean why. people like. old missouri look cashed out of countrywide financial cash one billion in stock options over your years and the company where nearly well how's that for growing inequality and it's all predicated on loose money and who has access to it and i love the way you put it those first to the party make out really well as those last to the party that get really crushed just to show one more chart before we go we can show what that decline in year over year increases in wages looks like next to the year over year increase in jobs and they're moving in opposite directions and as you indicate mesh there is just so much more behind these numbers that can even be factored in mike said not thanks so much for being on the show he's investment advisor at sic a pacific capital management and our go to jobs guy. close the show

11:24 pm

a. good measure. all right let's wrap up with your feedback because it's friday and we haven't done this for a while so we talked about catastrophe bonds in the wake of superstorm sandy and sean lack of rights i wouldn't have a heart to bet on a disaster that could affect many lives it's the same reason i don't have a heart to speculate on food prices and of course this brings up a lot of conspiracy theories about whether control of manipulated profit and what not i do want to clarify that as far as my understanding is of catastrophe bonds with the guess we spoke to what you're talking about is actually the opposite of

11:25 pm

these catastrophe bonds that we're talking about in the event of a major catastrophe you do not get paid on your bond or the value of your bond erodes in terms of the principle so you aren't actually betting on a disaster so to speak in fact it would seem that you would rather you would want them to not happen but hey who knows maybe there's a day when they're collateralized and you can short them i mean that's kind of were a financial innovation has gone in the past i don't know but i hear you about food speculation also publicly traded defense companies i think are treacherous and not same kind away so i appreciate your comment also we mulled over the misuse of disaster funds on the japanese tsunami disaster relief by the government and i had said yes but you hear the same stories with nonprofits with them misusing money and grad made a key distinction grad said i can stop paying nonprofits well i cannot stop paying ransom to the government and so i thought that was a really good point fair enough ok you can you can give to a nonprofit you don't decide if you give money to the government but yet if they.

11:26 pm

you know you're helpless now we talked about the merits of price gouging post sandy and ken wrote personally fifty dollars bags of ice are not ok but i sure as heck don't want the police state to come in and say that today fifty dollars bags of ice are not ok and tomorrow forty dollars bags of ice are not ok and you know i'm really glad you made the distinction because you may think something is immoral or disagree with that it doesn't mean you think the government should come in with in this case price controls and do something about it so that was what we were trying to get to and i'm glad that you summed it up well street legal aid wrote same old same old from capital account what i want to know is what would happen next on main street in the us if the federal reserve did as lauren and mr bonner want and withdrew q.e. liquidity support from wall street it's ok for capital account to argue the theoretical case for free market capitalism i do get it but i think there's also a duty to explain what would happen tomorrow if the us state intervention ended

11:27 pm

altogether today please address this issue you bring up a good point if you withdrew all government support right away you would probably have a collapse so big that people would become so distressed that the state would fill the vacuum again only this time the intervention would be worse than we've ever seen this is our guess therefore we do agree with you that it is it wise to withdraw all support all at once simply because it would open the door to more state intervention the reality is that we've gone so far down this road of statism and credit ism over decades that there really is no pleasant solution this is why we focus so much of our attention on encouraging people to take action in their own lives because most of the bad stuff may already be baked into the cake now longo where to writes lauren as a non us citizen ita long time no idea that you have more than two guys running for president i hear us people say i will not vote i understood there must be a law that without enough votes the election is invalid or people say i will write ron paul in why don't people just vote for another party i don't under. the

11:28 pm

ignorance of the media to mention the others are you sure us citizens know about the alternatives there are few issues more than i can get into in thirty seconds as to why the two party political system really has this stranglehold i mean there are barriers to getting on the ballot as a third party candidate raising a lot of money for elections is essential in the us to being winning president and third party candidates have a hard time raising it because as far as history investing in another candidate a third party candidate hasn't really delivered the returns as far as donors of course democrats and republicans have a vested interest in the status quo and use their money and influence to advance it and you bring up the point of the mainstream media you don't really see third party candidates covered by the mainstream media but you can see them covered here i do want to mention that monday night there is a third party candidate debate airing on r t at nine pm and tom hartman who has a show on the network will host a political panel at eight g three seven one to two rights by having guests like bill bonner jim rogers karl denninger etc on your show it's driving me to be

11:29 pm

criminally insane all they do is make sense you know y'all could be held legally liable for this i sure hope we do i sure i sure hope we are held liable because that's what we're here for and that's all we have time for today that's it for our show thank you so much for watching make sure to come back tomorrow and in the meantime you know you can follow me on twitter out lauren lyster you can like us on our facebook page to give us feedback on our show and you missed it you tube dot com slash capital account watch us in h.d. on hulu and from everyone here thank you for watching have a great weekend and a great night. this will change when america picks is pressed it made mostly rage walking the run times wrote pushing charter to russia as occupiers hunger strike it's true two parties still dictate. this election close guard.

31 Views

Uploaded by TV Archive on

Live Music Archive

Live Music Archive Librivox Free Audio

Librivox Free Audio Metropolitan Museum

Metropolitan Museum Cleveland Museum of Art

Cleveland Museum of Art Internet Arcade

Internet Arcade Console Living Room

Console Living Room Books to Borrow

Books to Borrow Open Library

Open Library TV News

TV News Understanding 9/11

Understanding 9/11